REAL AML SYSTEM

You Can Run. But You Can't Hide!

Most comprehensive checks with more than 20 search criteria providing complete coverage and beyond to meet regulatory compliance

On Board

On Board

GREEN AML REPORT

AMBER AML REPORT

OVERALL USER LOGIN

Important Notice: EAs/RESs are to FULLY comply with the PMLPFTF requirements for transactions that take place from 1 January 2026.

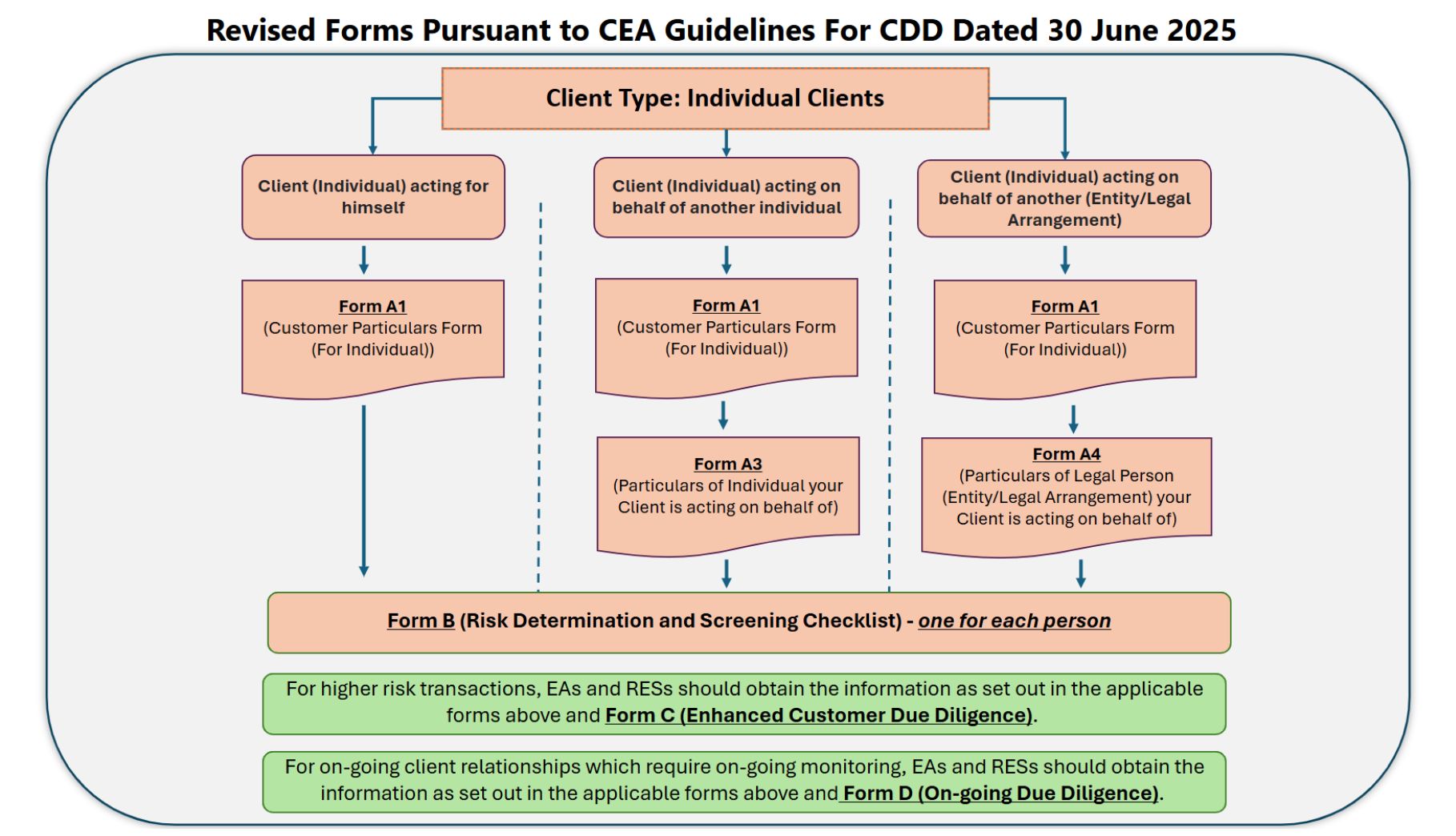

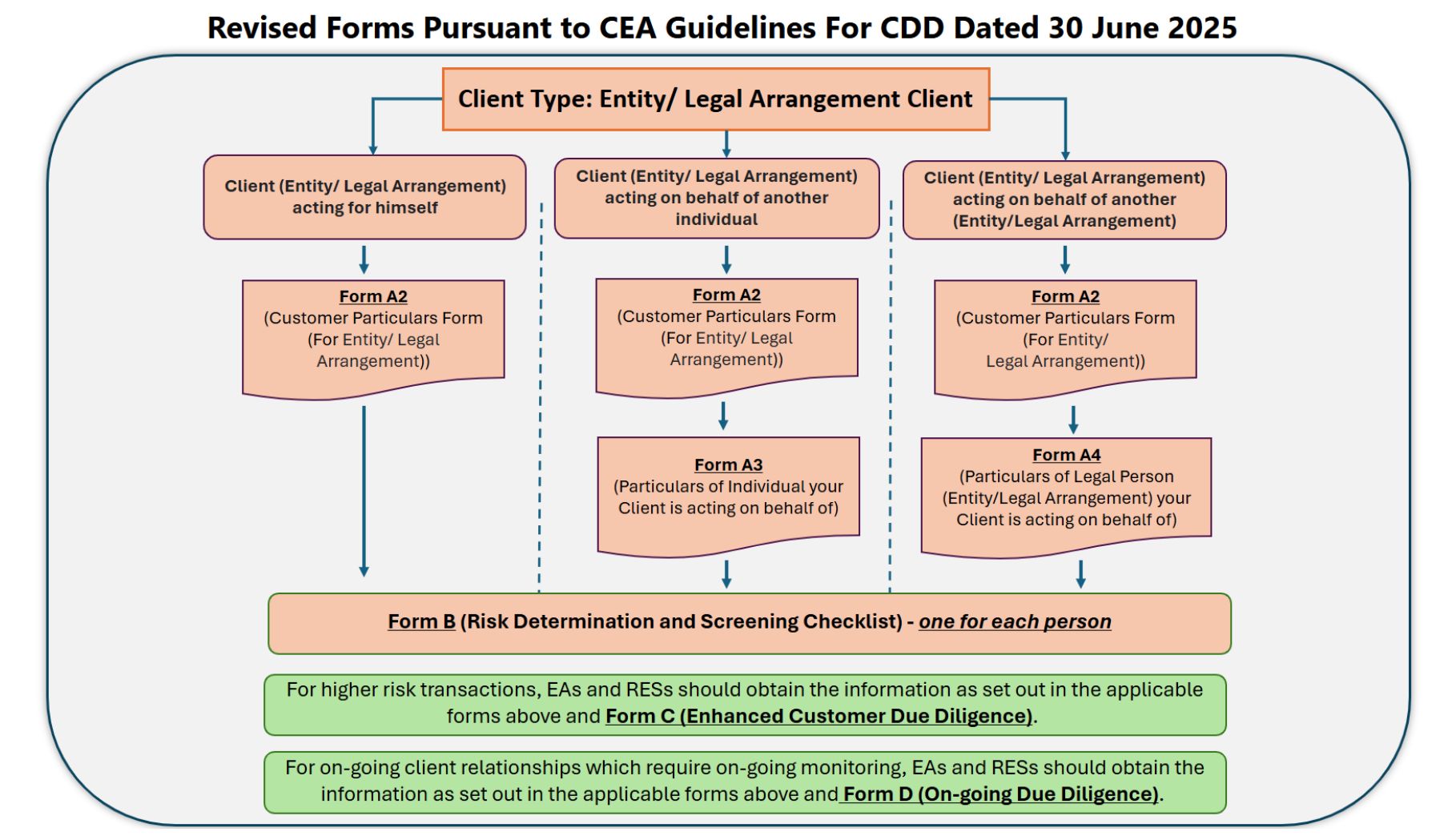

Following the Council for Estate Agencies (CEA)’s recent announcement on the updated guidelines for estate agents, which take effect on 30 June 2025, our team has already implemented the required changes to ensure full compliance across the portal.

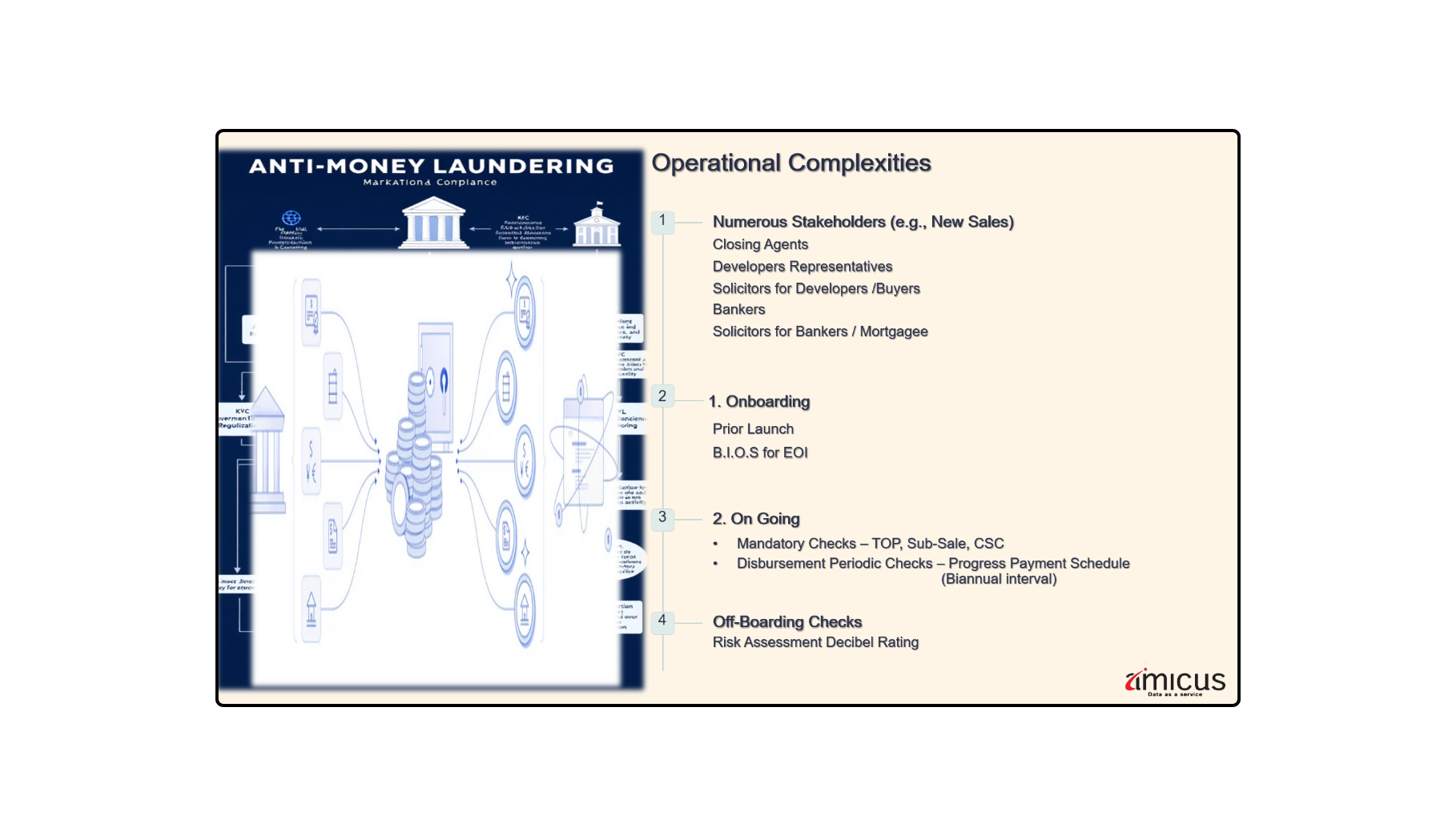

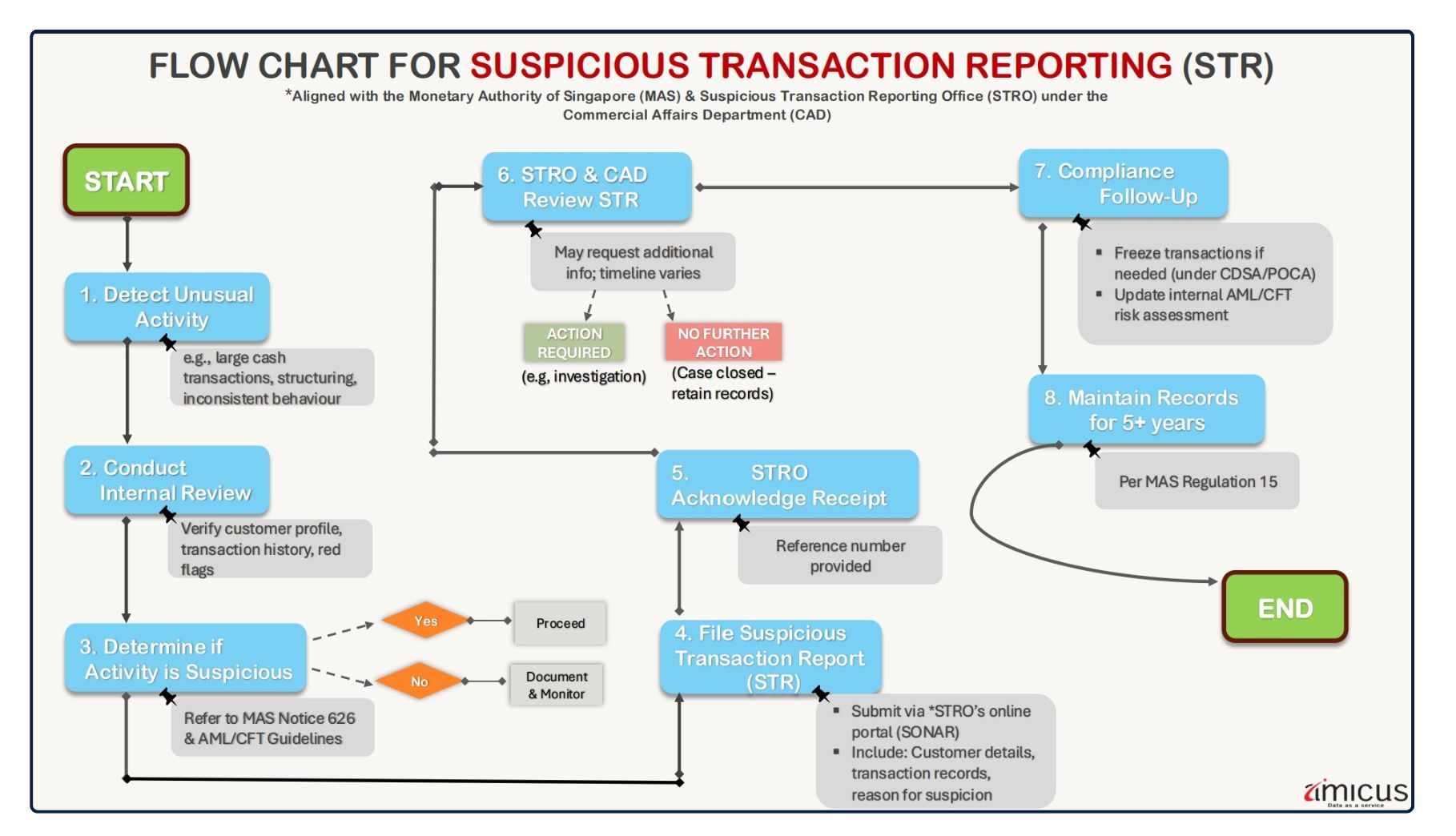

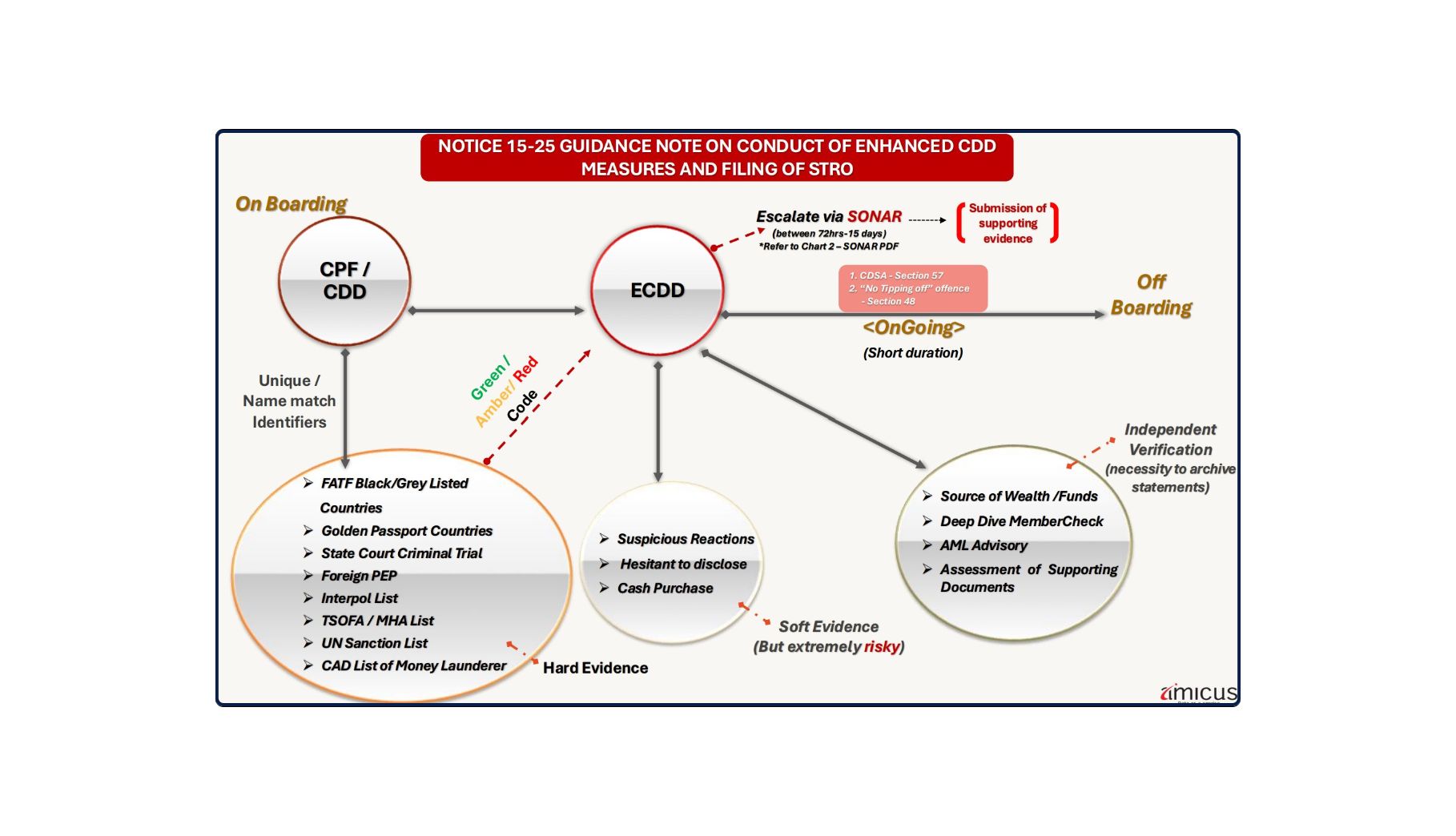

3 Dimensions of Anti-Money Laundering Process

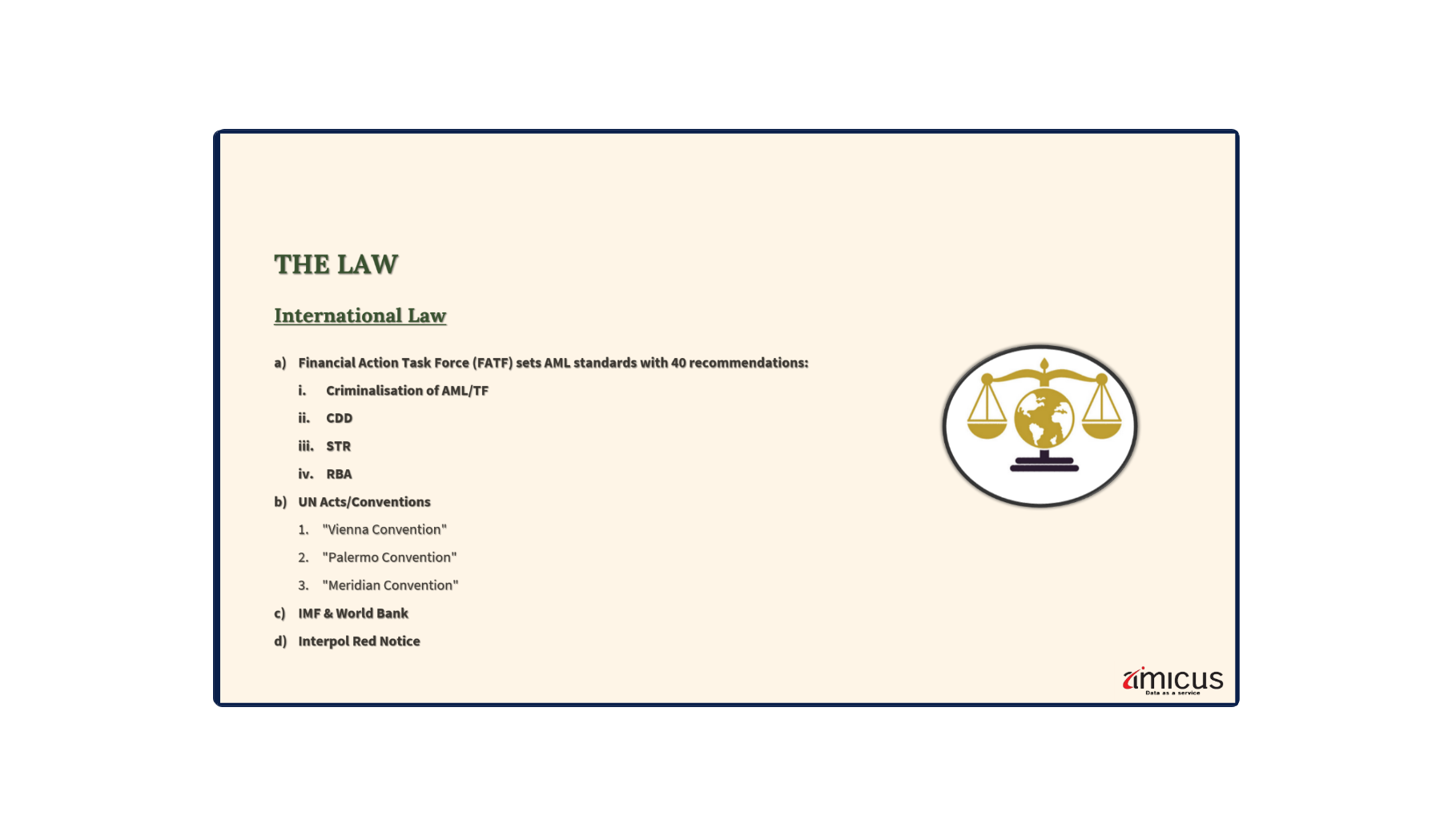

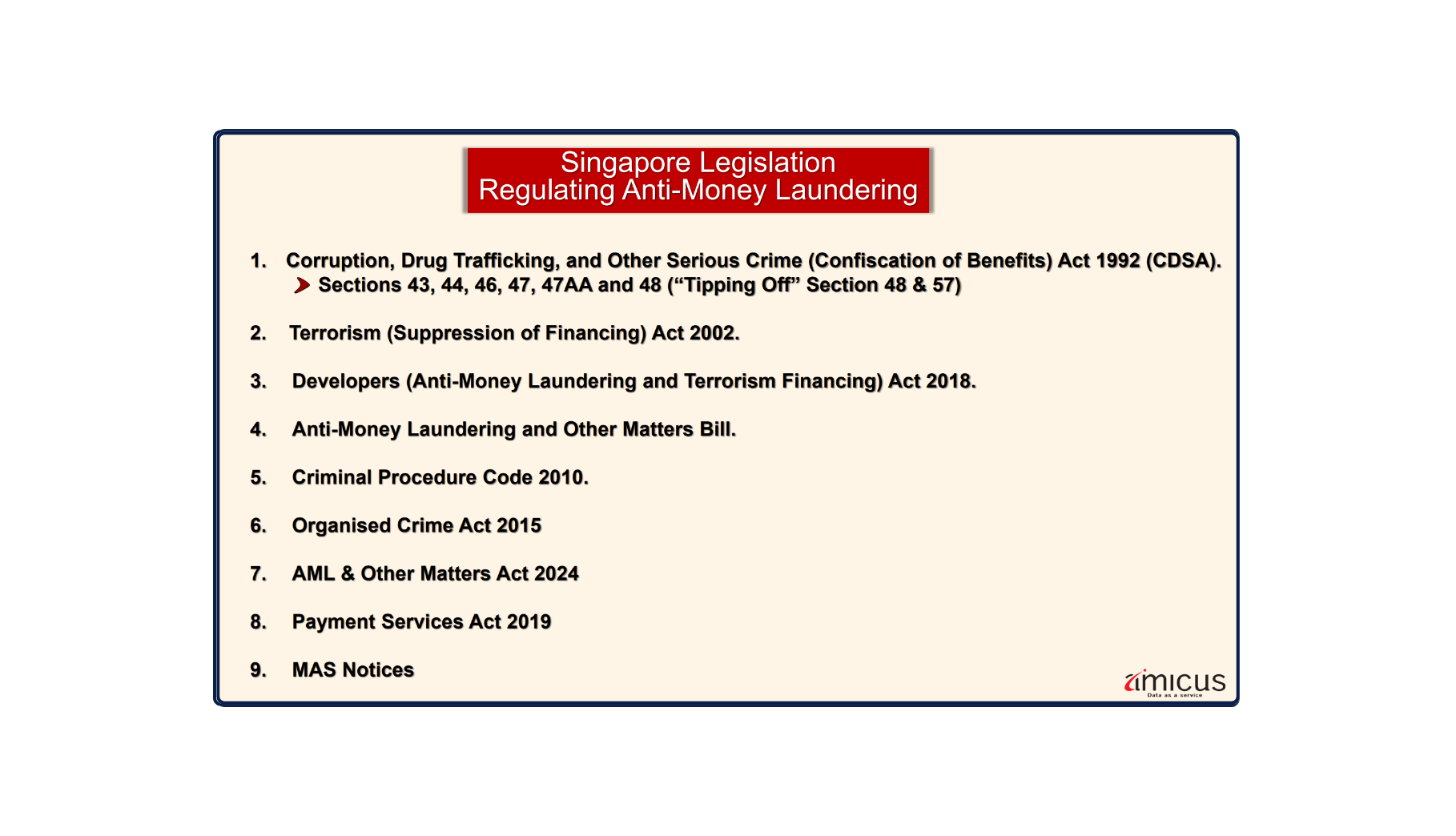

1) The Law

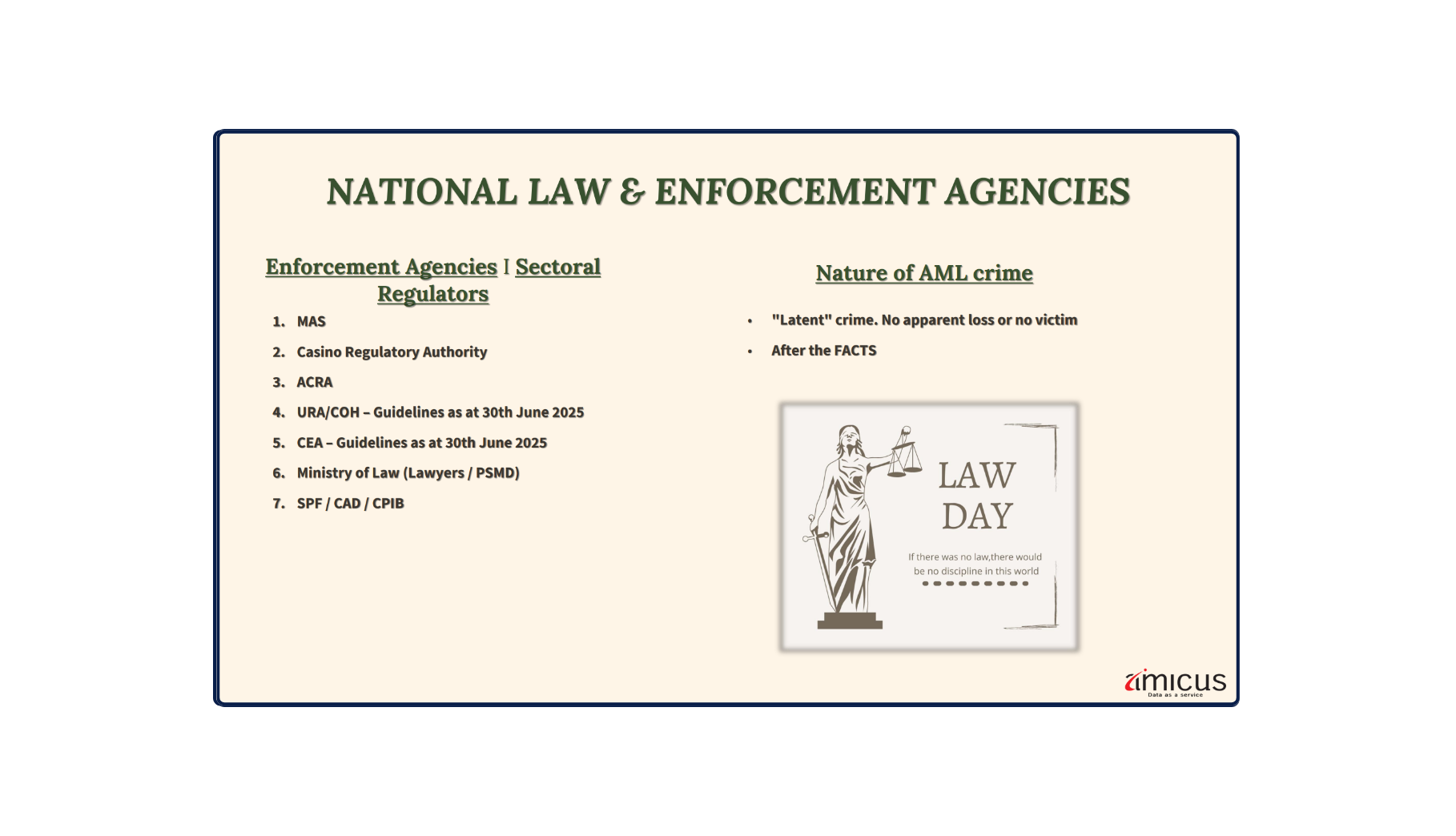

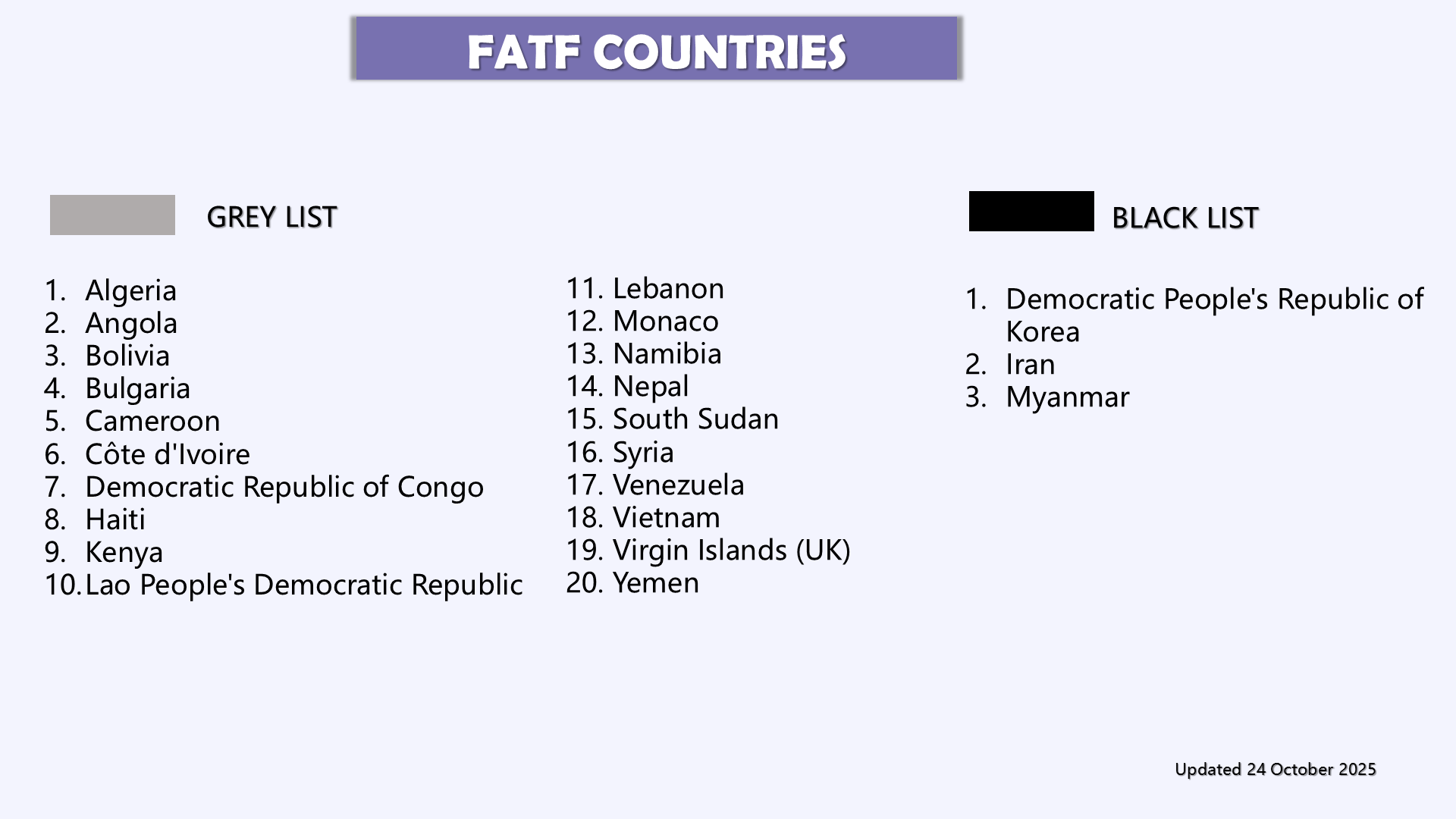

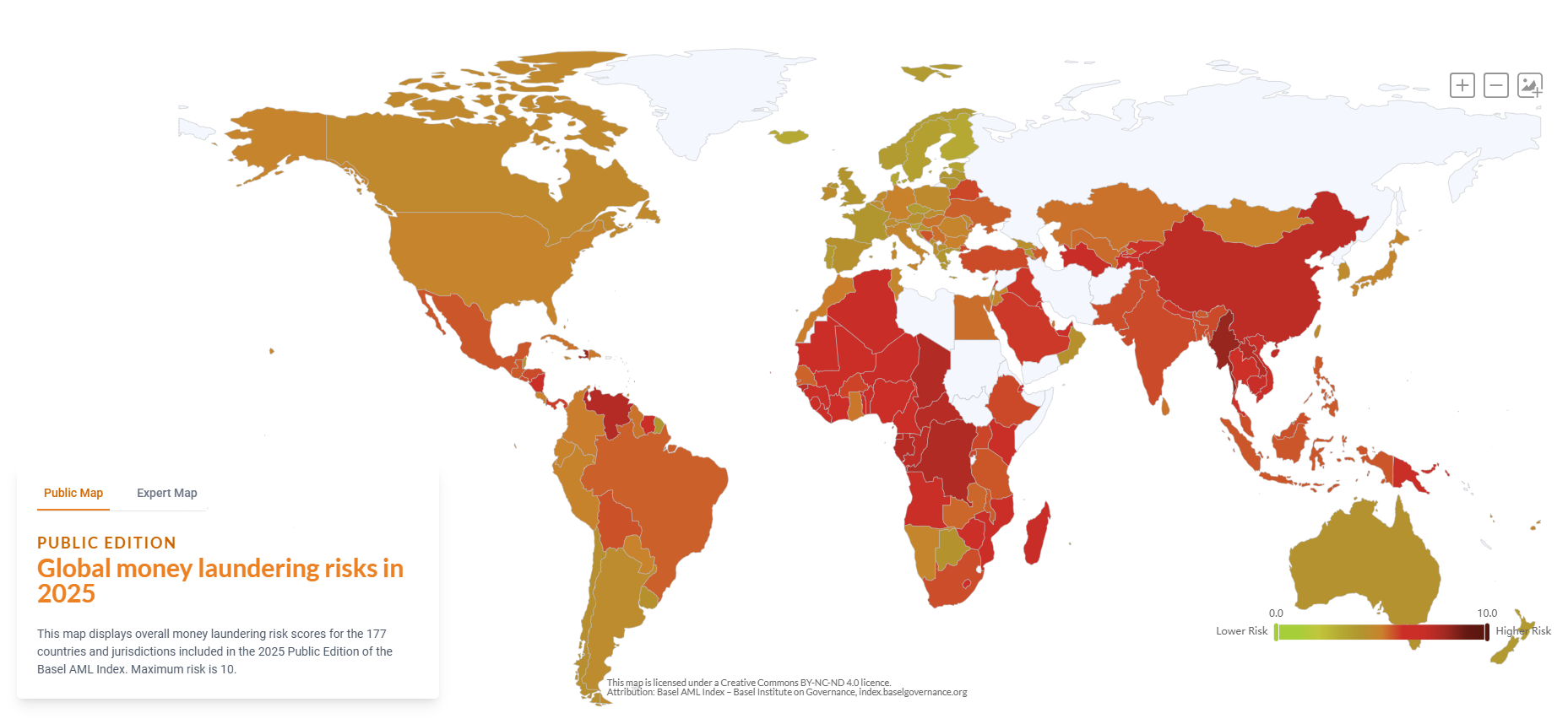

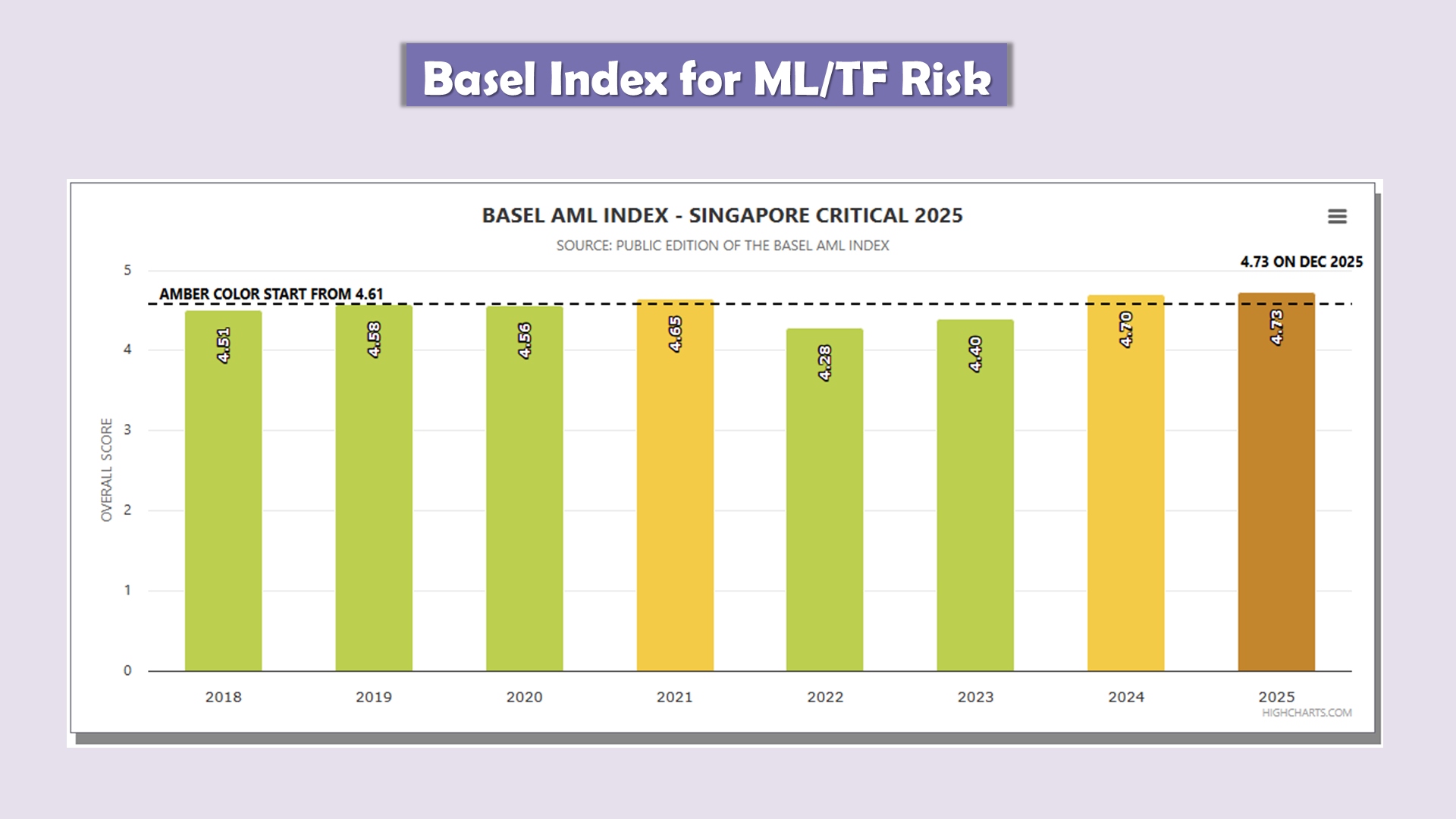

The legal landscape is shaped by international and national laws, with the Financial Action Task Force (FATF) setting global AML standards through its 40 recommendations, complemented by UN acts and conventions, frameworks from the IMF and World Bank, and enforcement tools like the Interpol Red Notice. At the national level, Singapore’s AML legislation, along with relevant national laws and enforcement agencies, plays a critical role in regulating and enforcing anti-money laundering measures.

Key Features of Amicus' AML Check

Conduct AML checks, view results, manage forms, and track audits—all in a single platform & designed for speed and simplicity without compromising on thoroughness.

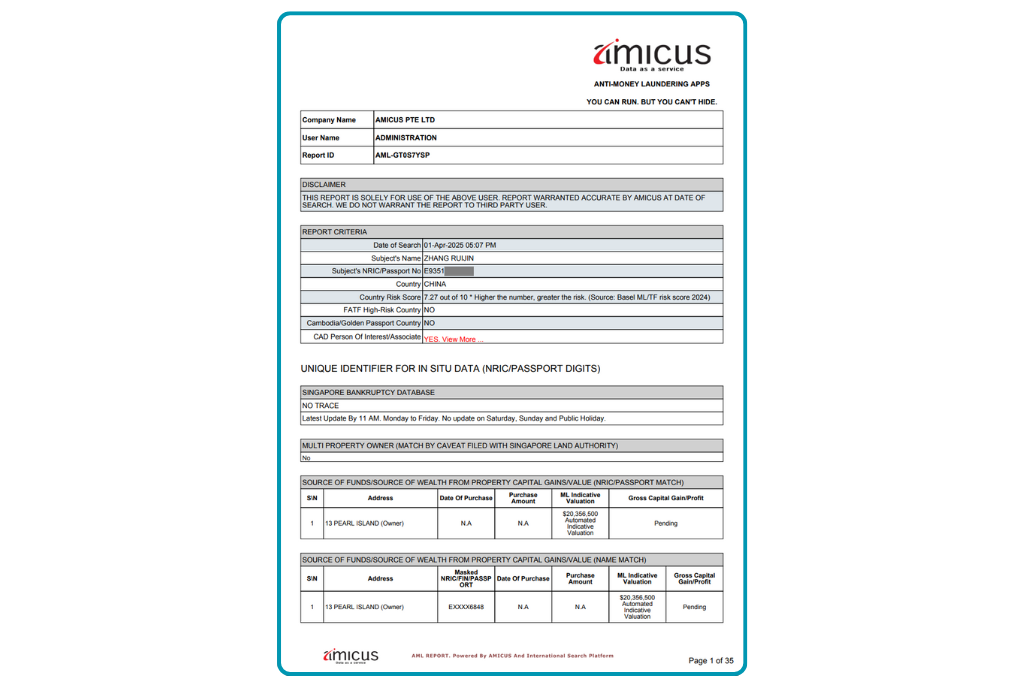

Verify Client's Source of Fund/Source of Wealth

Verify the client’s source of funds through their property holdings and business activities.

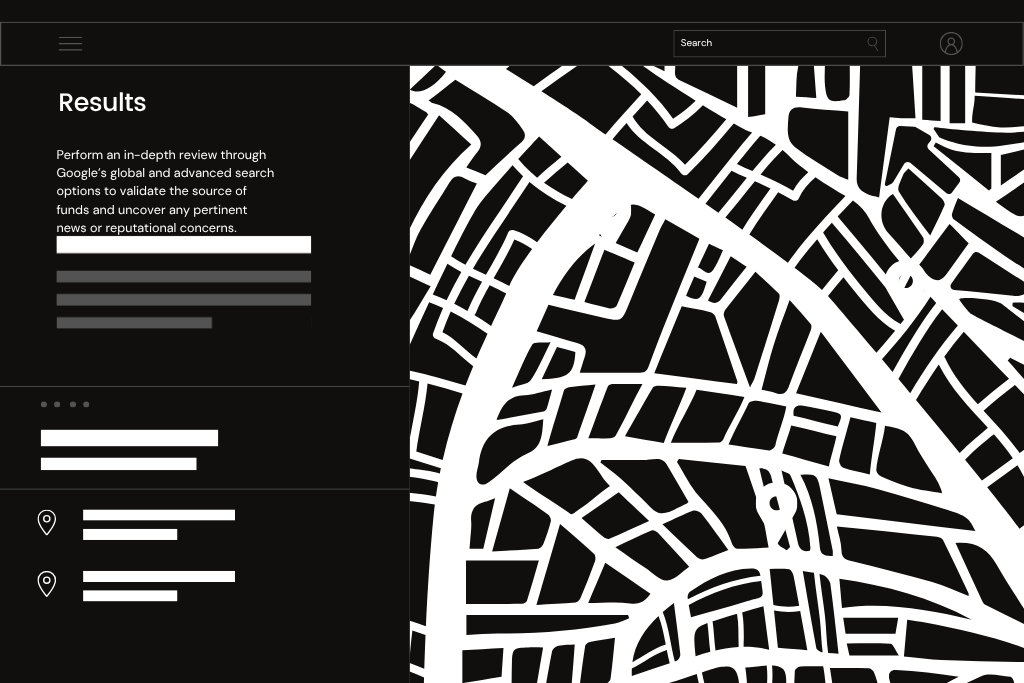

Conduct Worldwide Google Search

Utilize Google’s Worldwide and Advanced Search functionalities to verify the client’s source of funds and identify any other relevant news or public information.

Perform real-time State Courts Crimal Trials/Bankruptcy Check

Undertake a real-time examination of the client's financial solvency and bankruptcy history.

Real-Time Search Company's Director and Shareholder via ACRA API marketplace

Access real-time corporate ownership and directorship details using the ACRA API marketplace.

Use of Artificial Intelligence to verify names and identities

Application of Advanced Artificial Intelligence Methods to Authenticate and Validate Names with High Precision.

Check Over 1000 Databases World Wide

Comprehensive Screening Across More Than 1000 Leading Global Databases

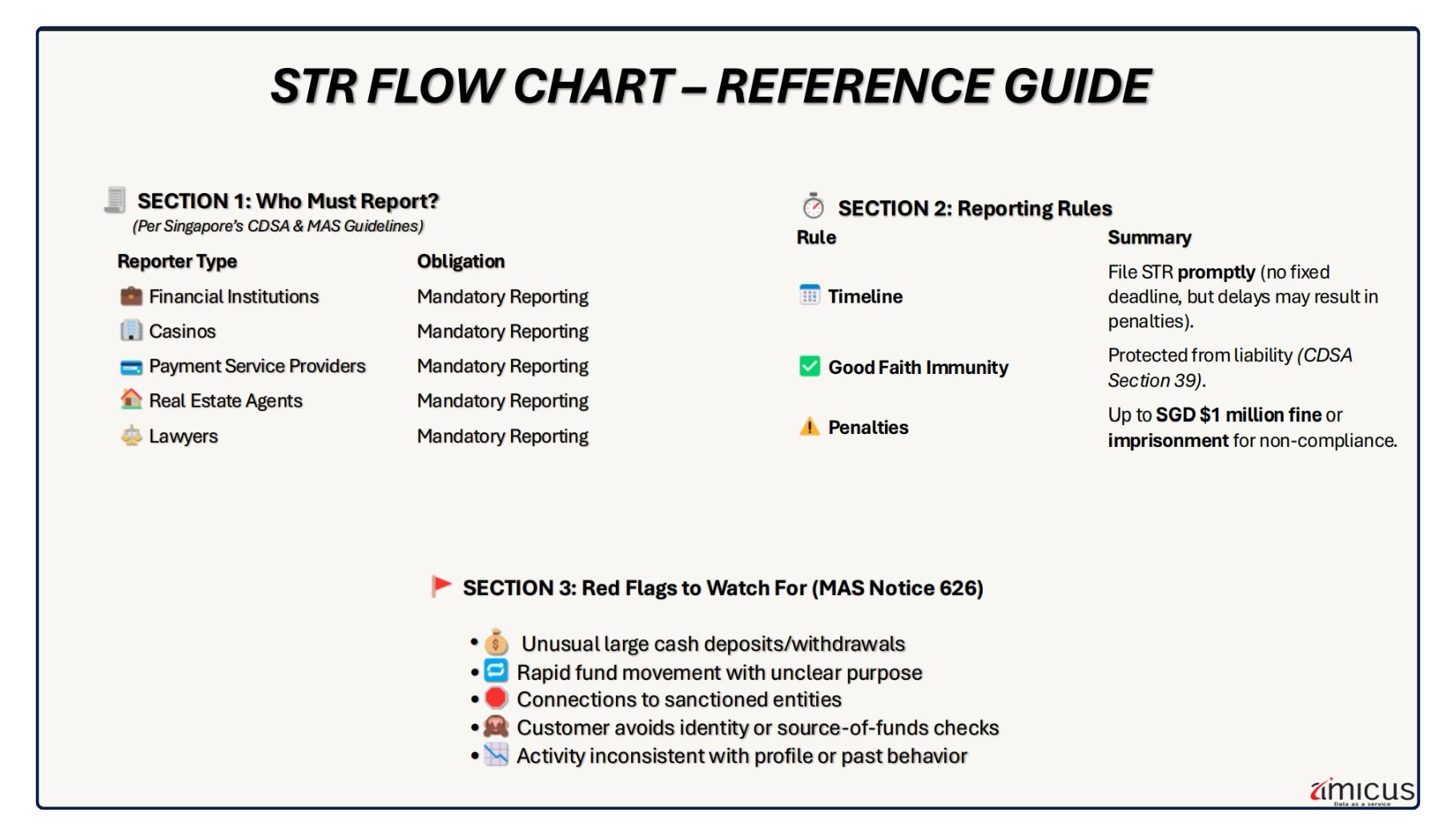

AML Report & Digitized Submission Forms

We provide a comprehensive Anti-Money Laundering (AML) reporting solution integrated with secure digitized form submission. It enables organizations to generate detailed AML compliance reports while facilitating the collection and processing of relevant documentation through electronic forms. By streamlining both reporting and documentation workflows, this system ensures regulatory adherence, data integrity, and operational efficiency within a fully digital environment.

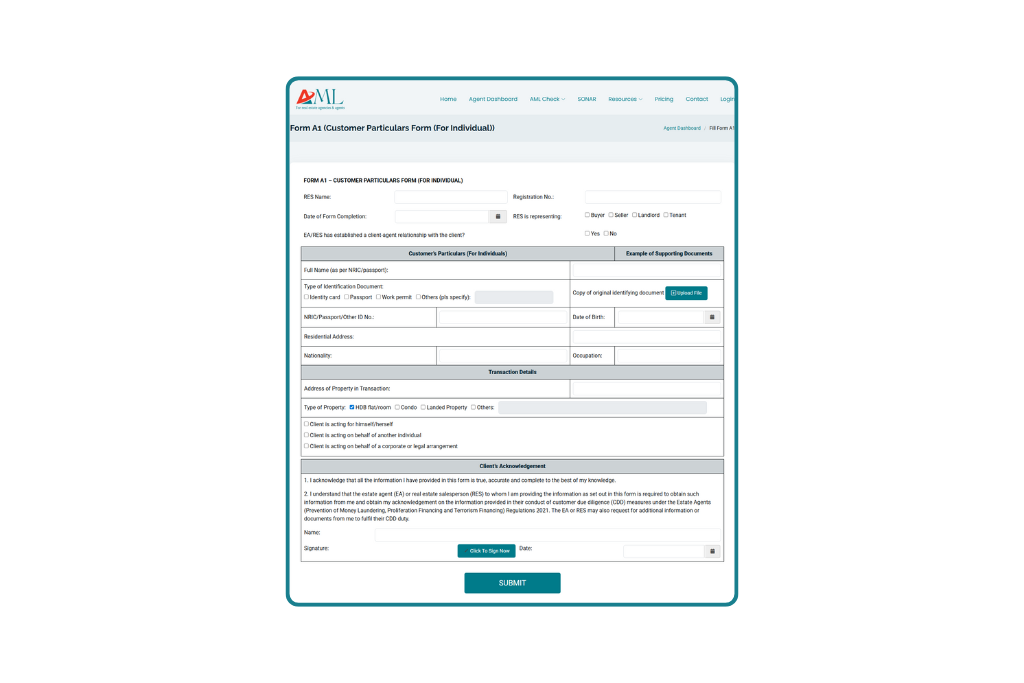

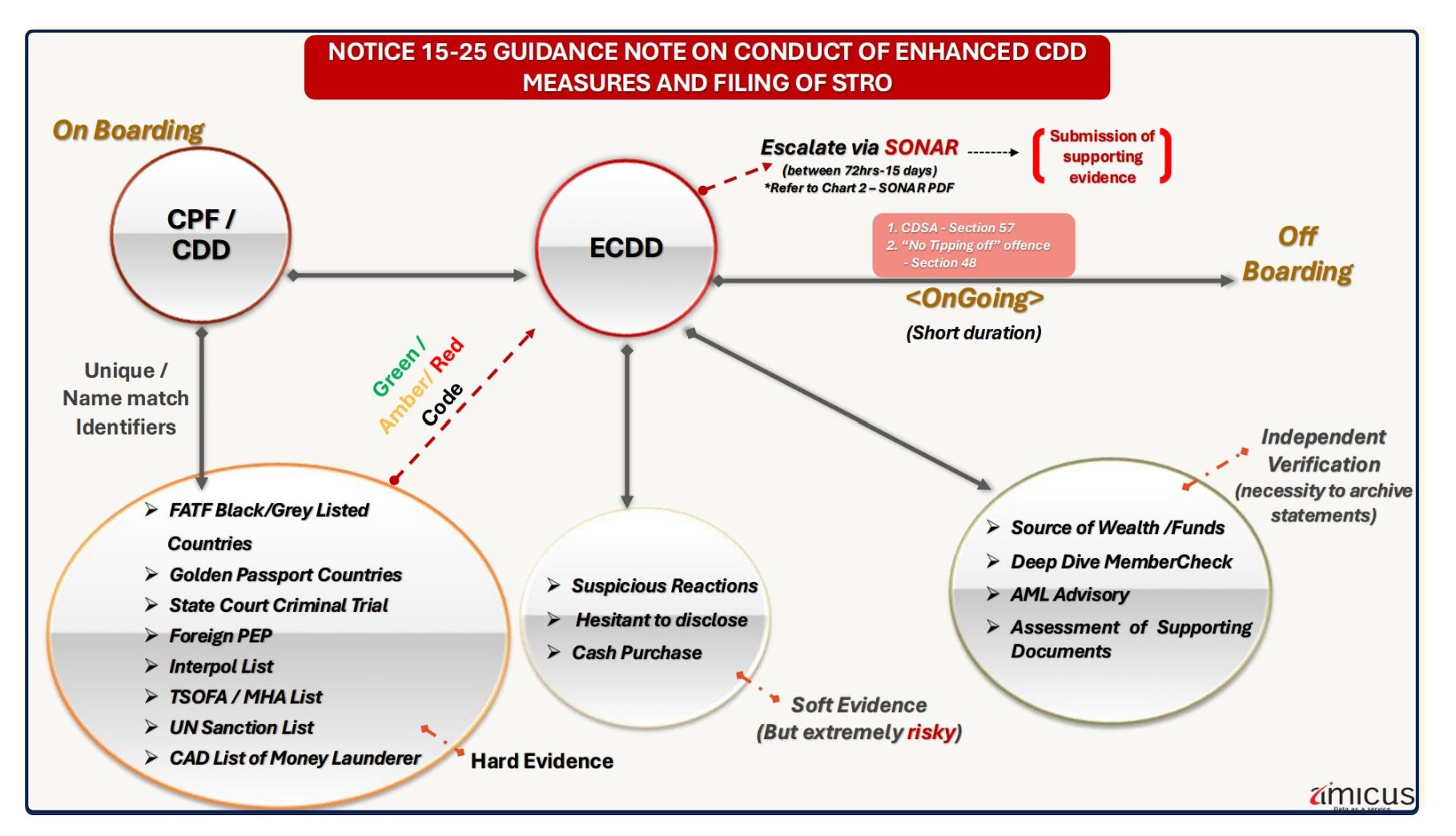

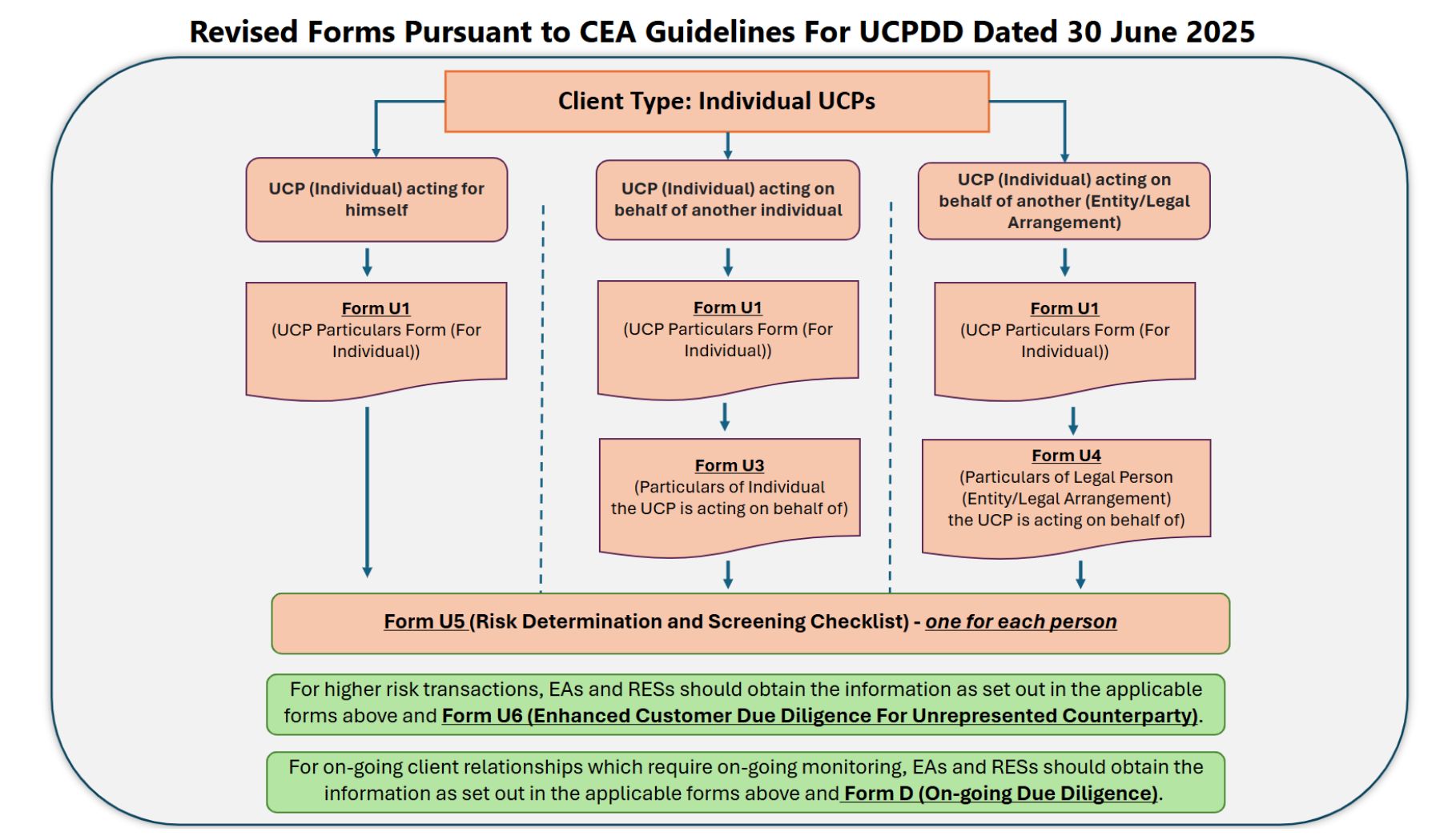

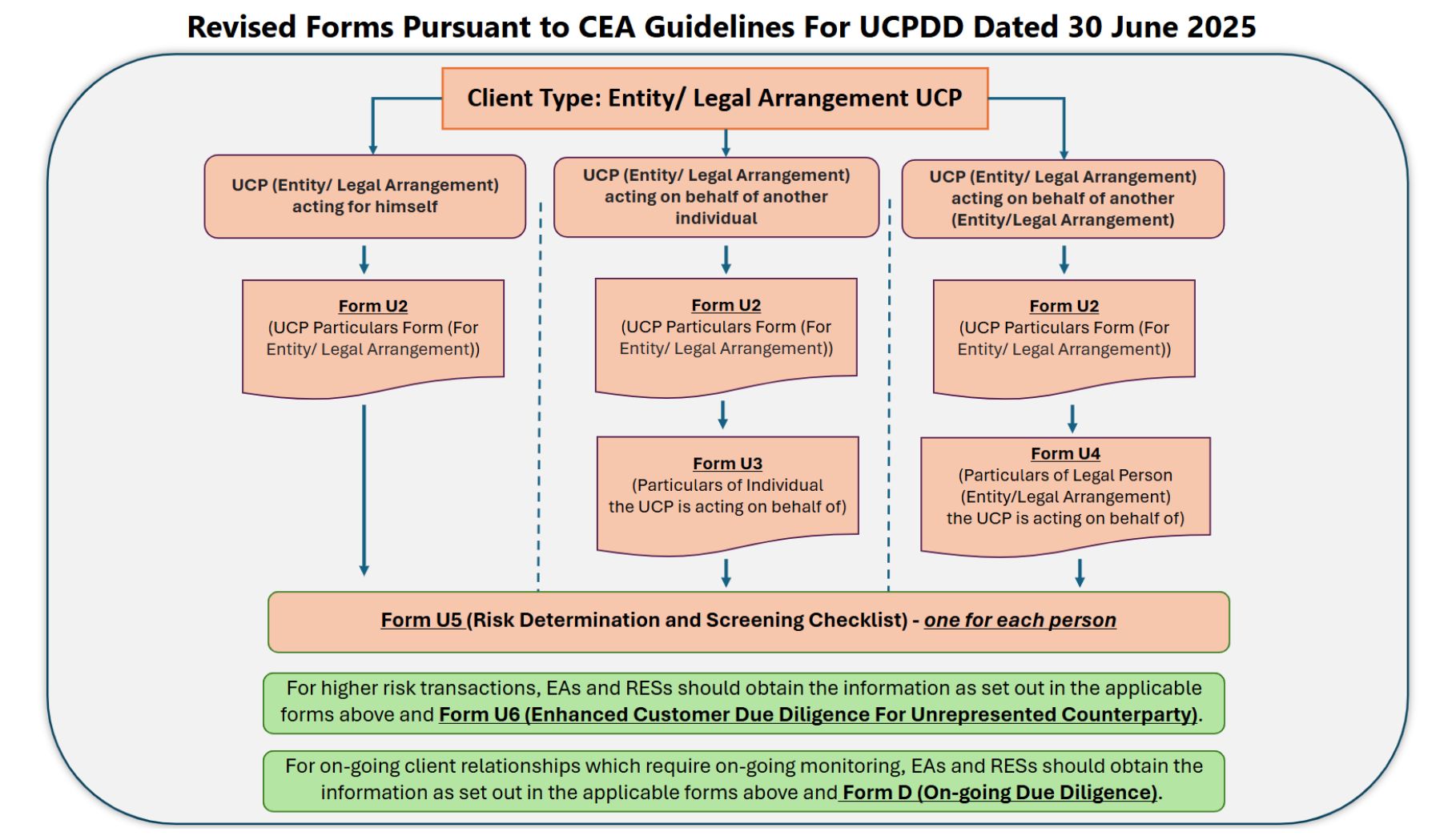

CDD For Client & DD For Unrepresented Counterparty Form Flow

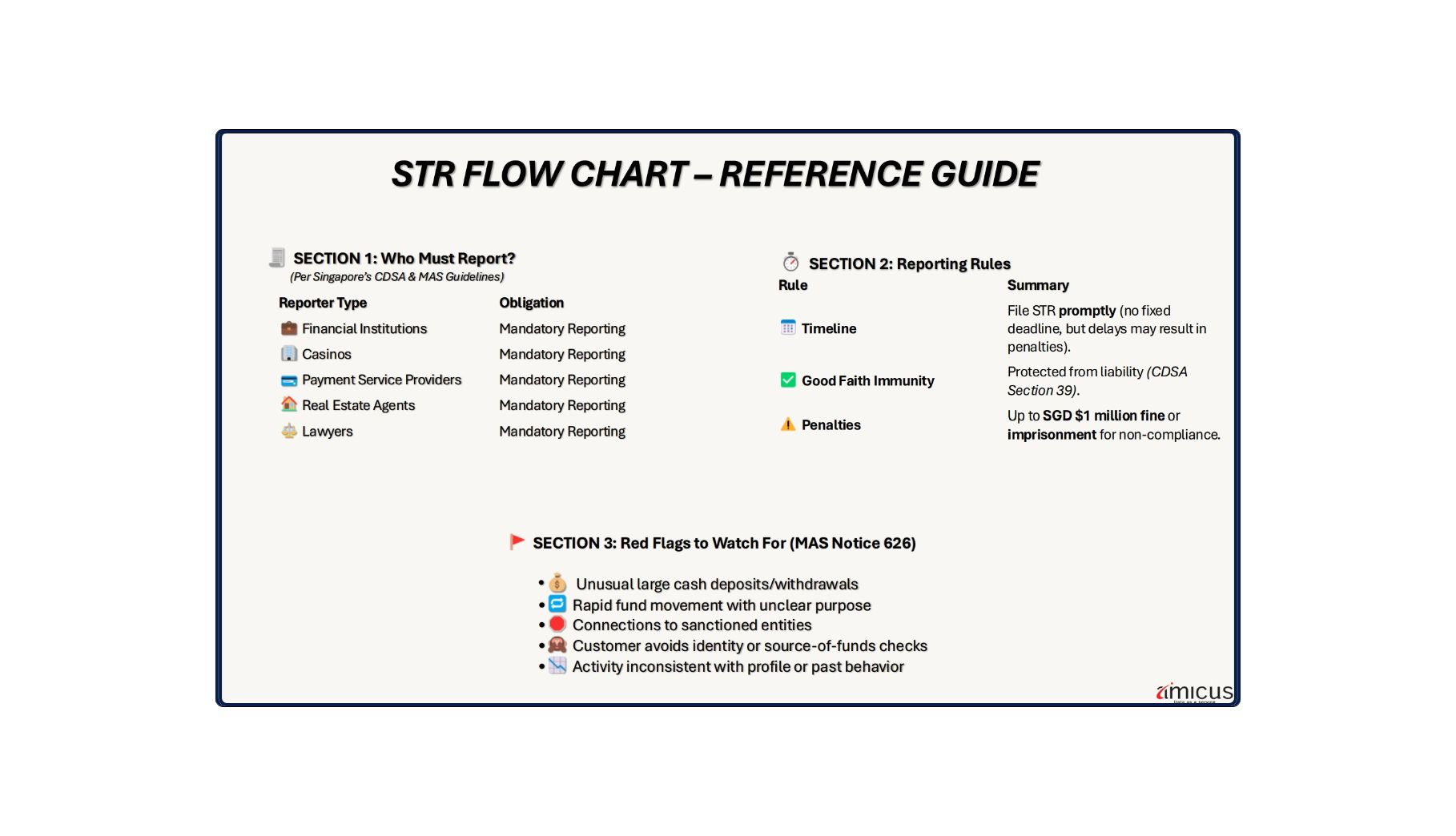

In compliance with the Council for Estate Agencies (CEA) regulations, all real estate salespersons are required to perform Customer Due Diligence (CDD) and Unrepresented Counterparty Due Diligence (UCPDD) as part of their obligations to prevent money laundering and terrorism financing.

Frequently Asked Questions

The following questions and answers are provided by the Council for Estate Agencies (CEA) and are based on the principles and requirements of Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) measures. They are intended to guide estate agents and salespersons in fulfilling their regulatory obligations under the applicable laws and CEA guidelines.

Q1:Can salespersons and clients complete and electronically sign the Customer’s Particulars Form and Real Estate Salesperson’s Checklist on Customer Due Diligence?

Q2: Do estate agents and salespersons have to complete the Real Estate Salesperson’s Checklist on Customer Due Diligence and Customer’s Particulars Form for every transaction that he facilitates for a client whom he has an ongoing relationship with?

Q3: Does a salesperson have to complete the Real Estate Salesperson’s Checklist on Customer Due Diligence for his client?